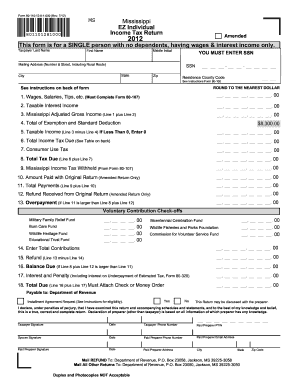

mississippi income tax forms

Mississippi tax forms are sourced from the Mississippi income tax forms page and are updated on. TaxFormFinder has an additional 36 Mississippi income tax forms that you may need plus all federal income tax forms.

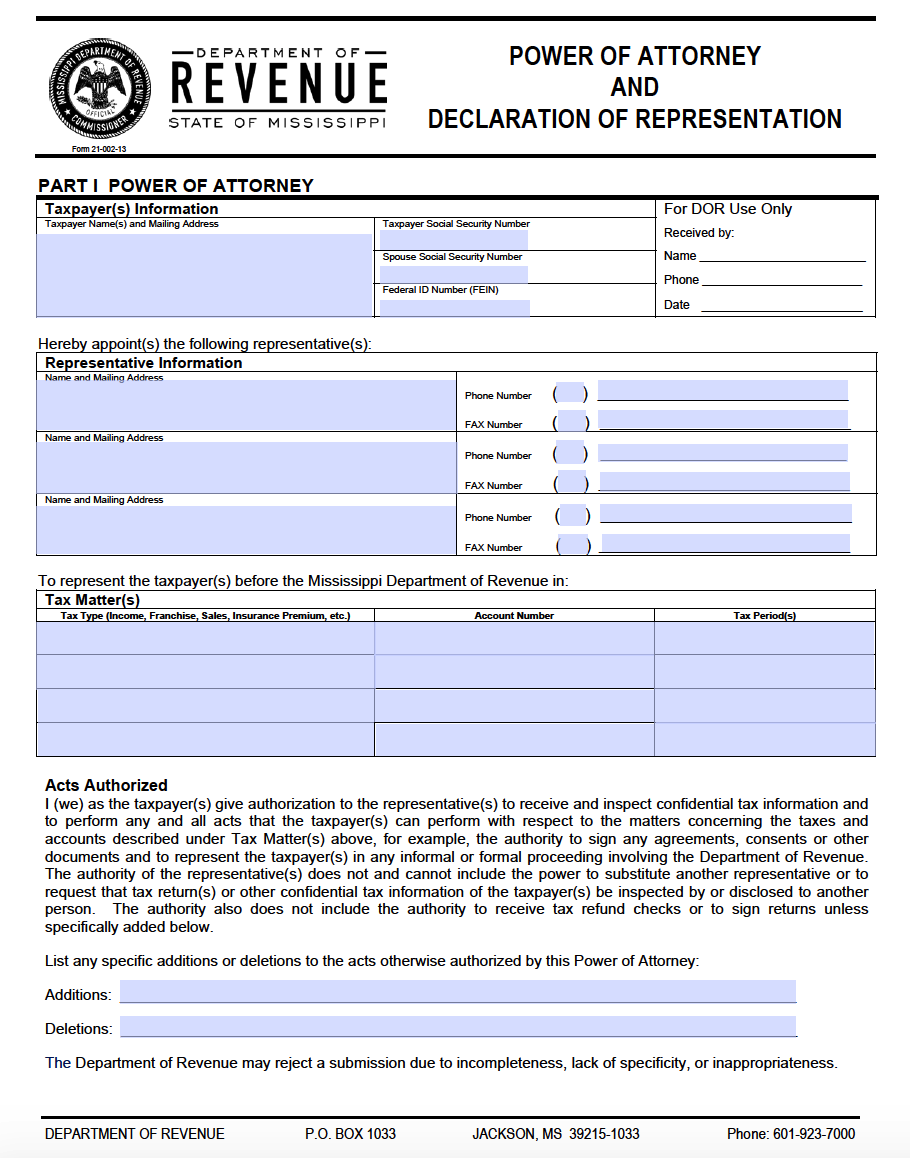

Free 8 Sample Limited Power Of Attorney Forms In Ms Word Pdf Formal Resignation Letter Sample Teacher Resignation Letter Resignation Letter Sample

This website provides information about the various taxes administered access to online filing and forms.

. 0921 Mississippi Page 1 Print Form Net Taxable Income Schedule 2021 831222181000 FEIN ROUND TO THE NEAREST DOLLAR COMPUTATION OF MISSISSIPPI NET TAXABLE INCOME 1 Federal taxable income loss before net operating loss deductions and special deductions from federal Form 1120 page 1 line 28. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. These back taxes forms can not longer be e-Filed.

The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. Mississippi has a state income tax that ranges between 3 and 5 which. Mississippi State Income Tax Forms for Tax Year 2021 Jan.

Individual Tax Return Form 1040 Instructions. Instructions for Form 1040 Form W-9. Details on how to only prepare and print a Mississippi 2021 Tax Return.

Mississippi state tax forms gained its worldwide popularity due to its number of useful features extensions and integrations. Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. 24 Mississippi income tax withheld complete Form 80-107 25 Estimated tax payments extension payments andor amount paid on original return.

Use this instructional booklet to aid you with filling out and filing your Form 80-105 tax return. These 2021 forms and more are available. You must file online or through the mail yearly by April 17.

Individual Tax Return Form 1040 Instructions. You must file online or through the mail yearly by April 17. Estimated Tax for Individuals.

All other income tax returns P. Tax Forms Instructions. Mississippi Form 80-205 Nonresident and Part-Year Resident Return.

19 rows 37 PDFS. Request for Taxpayer Identification Number TIN and Certification. 42 Interest income from Form 80-108 part II line 3 43 Dividend income from Form 80-108 part II line 6 39 Capital gain.

Ad Download or Email IRS 990 More Fillable Forms Register and Subscribe Now. Below are forms for prior Tax Years starting with 2020. Form 1040-ES is used by persons with income not subject to tax withholding to figure and pay estimated tax.

Once you have completed the form you may either e-mail it as an attachment to candsmdesmsgov or fax it to 601-321-6173 or print it out and mail it to. Other Mississippi Individual Income Tax Forms. Welcome to The Mississippi Department of Revenue.

For instance browser extensions make it possible to keep all the tools you need a click away. Taxpayer Access Point TAP Online access to your tax account is available through. With the collaboration between signNow and Chrome easily find its extension in the Web Store and use it to eSign.

Earned Income Credit EITC Advance Child Tax Credit. Mississippi Form 80-108 Adjustments and Contributions. A downloadable PDF list of all available Individual Income Tax Forms.

The current tax year is 2021 with tax returns due in April 2022. The Department of Revenue is responsible for titling. Payment Voucher and Estimated Tax.

41 Interest income from Form 80-108 part II line 3 42 Dividend income from Form 80-108 part II line 6 38 Capital gain loss attach Federal Schedule D. 23 Total Mississippi income tax due line 20 plus line 21 and line 22 24 Mississippi income tax withheld complete Form 80-107 25 Estimated tax payments extension payments andor amount paid on original return. The Department of Revenue is the primary agency for collecting tax revenues that support state and local governments in Mississippi.

The state income tax table can be found inside the Mississippi Form 80-105 instructions booklet. Earned Income Credit EITC Advance Child Tax Credit. Mississippi Form 80-160 Other State Tax Credit.

Many states have separate versions of their tax returns for nonresidents or part-year residents - that is people who earn taxable income in that state live in a different state or who live in the state for only a portion of the year. Form 80-105 requires you to list multiple forms of income such as wages interest or alimony. Mississippi Form 80-105 Resident Return.

23 Mississippi income tax withheld complete Form 80-107 24 Estimated tax payments extension payments andor amount paid on original return. 31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due dateIf you file a tax extension you can e-File your Taxes until October 15 2022 October 17 2022 without a late filing penaltyHowever if you owe Taxes and dont pay on time you might face. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

The Mississippi income tax rate for tax year 2021 is progressive from a low of 0 to a high of 5. Form 80-105 - Individual Income Tax Return. The 2022 state personal income tax brackets are updated from the Mississippi and Tax Foundation data.

Form 80-100 - Individual Income Tax Instructions. Reset Form Form 83-122-21-8-1-000 Rev. Form 80-105 is the general individual income tax form for Mississippi residents.

Box 23050 Jackson MS 39225-3050. Form 80-105 is the general individual income tax form for Mississippi residents. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets.

Mississippi state filing information for tax-exempt organizations. 38 Wages salaries tips etc. POPULAR FORMS.

These nonresident returns allow taxpayers to specify. Form Code Form Name. Box 22781 Jackson MS 39225-2781.

42 Interest income from Form 80-108 part II line 3 43 Dividend income from Form 80-108 part II line 6 39 Capital gain loss attach Federal Schedule D if applicable. While most taxpayers have income taxes automatically withheld every pay period by their employer taxpayers who earn money that is not subject to withholding such as self employed income investment returns etc are often required to make estimated tax payments on a quarterly basis. Most states will release updated tax forms between January and April.

Download the Employer Change Request form. Mississippi Department of Employment Security Tax Department PO. 26 Mississippi income tax withheld complete Form 80-107 20 Income tax due from Schedule of Tax Computation see instructions.

Department of Revenue - State Tax Forms. Request for Taxpayer Identification Number TIN and Certification. Complete Form 80-107 Mississippi Income ONLY 51 Payments to self-employed SEP SIMPLE and qualified retirement plans Total Income From All Sources 50 Payments to IRA 58 Self.

Instructions for Form 1040 Form W-9. Form 80-205 is a Mississippi Individual Income Tax form. Form W-4 PDF.

Form 80-106 is a Mississippi Individual Income Tax form. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

Mississippi Monthly Lease Agreement Template Download Free Printable Legal Rent And Lease Template Rental Agreement Templates Lease Agreement Being A Landlord

Hipaa Confidentiality Agreement Template Free Pdf Word Doc Apple Mac Pages Google Docs Communication Plan Template Contract Template Company Financials

Mississippi State Printable Tax Forms Fill Online Printable Fillable Blank Pdffiller

Microsoft Debuts Office Lens A Document Scanning App For Ios And Android Techcrunch Office Lens Scanner App Scan App

Free Tax Power Of Attorney Mississippi Form Adobe Pdf

Printable Sample It Services Contract Form Contract Template Cleaning Contracts Free Basic Templates

Income Tax Filings In These U S Counties Were Audited At A Higher Rate Than The Nation As A Whole Infographic Map Map Data Visualization Map

Mississippi Monthly Lease Agreement Template Download Free Printable Legal Rent And Lease Template Rental Agreement Templates Being A Landlord Lease Agreement

File Accurate Income Tax Returns In The Safest Way Possible Via E File Opt For Direct Deposit As The Quickest Method T Income Tax Tax Return Income Tax Return

Healthy Habits Healthy Habits How To Stay Healthy Developing Healthy Habits

Idaho Tax Forms And Instructions For 2021 Form 40

Attala County Mississippi 1911 Map Rand Mcnally Kosciusko Ethel Mcadams Mccool Zebulon Ayers Mcville Zemuly Waugh Heal County Map Mississippi Map

Police Officer Resume Example Template Influx Resume Examples Police Officer Resume Job Resume Examples

Pin By Pam Harbuck On Elvis Presley The Early Years Elvis Elvis Quotes Income Tax Return

Income Tax Filings In These Counties Were Audited At A Lower Rate Than The Nation As A Whole Infographic Map Native American Reservation Months In A Year

We Make A Personalized High Quality Paycheck Stub W Company Logo For You Including Income Taxes Deductions Ytd Totals Credit Card App Paycheck Income Tax

Annual Revenue Tracker Printable Planner Insert Annual Profits Log Annual Planner Financial Tr Annual Planner Planner Inserts Printable Printable Planner

Birth Certificates Mississippi State Department Of Health Birth Certificate Mississippi State Health